Why Is Gold Falling In Price

- October 23rd, 2008

- Posted in WTC Coin News

I bought gold about 4 years ago as in my economical teachings I had always learn if the world are in a crises people will start buy gold as a safe investment. Well looking at the last month of turbulent markets all over the world gold has only gone one way and that has been down. So I wanted to find out what was different this time compared to what the books are telling us would happen when the market goes down. Well looking around on the web I found a great explanation at this blog.http://blog.adamnash.com/2008/10/24/why-the-price-of-gold-is-sinking-fast/

He Mr. Adam Nash is telling us that people are selling gold to meet margin calls on other investments they have so they have to sell gold. To me that sounds like a reasonable explanation considering the fast collapse of the US and world markets. But does it not also mean that if a hedge fund or mutual fund sells gold to meet market calls that they have to at sometime buy that gold back to keep their risk profile the same as they have advertised to consumers. I think it does and I think it means that the gold will go back up when the markets starts to stabilize again as the people selling gold now really have to sell but they don't want to sell. So they will buy back as their portfolio gets back in the black.

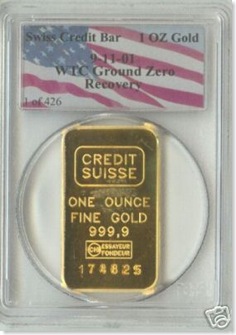

Well its funny to see how the WTC coins and bullion are not affected by the gold and silver price as 1oz. gold coins still sell for a minimum of $1,200 -1,400 and silver coins sell for a minimum of $70 with 1 oz of silver at $10. This makes WTC coins a much safer investment that regular bullion coins which I guess a few people have found out given the recent activity on E-bay. Right now over 150 world trade center coins are up for auction where a normal number in the last 6 month has been around 100 coins.